Getting protein into cassava: follow up to a recent conference

Lunch with a cassava expert reveals some of the true obstacles to rotating a protein crop with cassava in south east Asia

After the recent World Tapioca Conference in Thailand, I was able to have lunch with an old friend. He is now mostly retired from the industry, but retains a vast amount of knowledge concerning how cassava is grown in practice in the field. He has undoubtedly had a great impact on the development of cassava in Thailand. I put to him the arguments I made in my presentation, which focussed on various ways to get protein into the cassava processing industry, particularly through crop rotations. I draw from this discussion the following main points:

AI is starting to have a real impact on cassava productivity

Thailand has a well worked out breeding strategy, and has been successful in introducing new root varieties including for disease resistance. This is mainly an industry led initiative through institutions such as the Thai Tapioca Development Institute, often collaborating with CIAT.

Some would argue that the industry has not been quick enough to embrace the cutting edge of breeding these days, which involves a lot of gene editing, but nevertheless there is a good breeding system in place, well ahead of what is available in most other producing countries. Who will carry the torch forward? That’s a more open question, since many of the leading lights of these Thai institutions are now, if not retired, certainly not young. The presentation was partly a call to a new generation to embrace the fast moving field of proteins, augmented by AI, to develop tapioca as a crop.

Still, cassava husbandry, the cultivation practices that make a real difference to productivity, is left mainly to individual companies and the teams they can assemble. Ask a major starch processor in Thailand how easy it is to assemble a good crop sourcing team and you will get some rolling of eyes and heavy breathing. You need experienced agronomists who can also handle farmers and corporate politics, a heady mix. There are outreach programs within the institutions to educate farmers, but these tend to be less formalised than the breeding programs.

It is in this area that my friend believes AI is starting to make a real difference. Farmers, and from across the income spectrum, since many are still quite poor, need only some kind of phone to get access to AI, either directly or through chat groups. This is a growing industry. The breakthrough may be that, in the past, and as my friend describes it, communication between researchers and farmers was limited. Well worked out strategies to raise productivity were not necessarily implemented because the farmer’s perspective was not always incorporated into the discussion. Now natural language apps — and critically, language that reflects the way farmers actually speak — is making its way into the field and through this a range of techniques (how to plant, how to weed, fertilise etc) are now more accessible to farmers.

Controlled farming conditions will more slowly be introduced in to the cassava field, probably through increased use of machines

To put this in context, it is now possible in controlled farms (essentially high value crops grown in green houses) to regulate things like precipitation and temperature according to the growth stages of the plant. AI can effectively recognise these stages from what the plant looks like and apply inputs accordingly and in controlled doses.

Of course these systems are incredibly expensive and not immediately available at scale and in the field. Nevertheless, the introduction of irrigation and machinery on a larger scale may change this. Right now, these things are also very expensive, but often this is because they are under utilised. For example, there are now new experiments with cassava planting and harvesting machinery, which is still very limited in Thailand. On a per hectare basis, machinery is costly, but as it is better adapted to conditions in the field, costs could fall quickly. To give some sense of the issues, comprehensive planting and harvesting machinery costing between tens and hundreds of thousands of dollars, depending on the units, and used on one hundred hectares — still a very large farming area in south east Asia — and depreciated over ten years, still likely destroys the crop economics. But here is the opportunity, and my friend gave a simple example.

To use some of these machines roots need to be planted a fixed distance apart. Right now, different farmers in different fields may use slightly different planting distances. This would prevent a machine being shared between neighbouring fields, and radically increase unit costs. However, once this knowledge gets out, it seems likely that there will be greater unity in planting practices, then machines may effectively be shared or rented out between neighbouring farms. Unit fixed costs could fall rapidly, and some issues with labour availability would vanish.

I immediately thought of those robot vacuum cleaners, devices that can scoot around your living room perhaps at night, sweeping up your kid’s lunch. You can easily imagine a rainfall and temperature pattern being recorded by one of these new planting machines, which then sets off automatically in the middle of the night to do some planting, working its way around several farms, crossing ditches and so on. I’m guessing this technology is now very much a reality. The implementation? That’s a different matter. The more standardised are farming practices, the easier it is to adopt a technology. But those standardised practices had better be good ones so as not to lock in poor technology.

Right now, this looks to be a major hurdle for the implementation of machinery on farms across south east Asia. Mechanisation is going more slowly that you might imagine and partly this is because most farms are still small holdings. A market needs to develop that standardises crop conditions across farmers and then rents out machinery at reasonable cost. I believe many farmers, whose kids often disappear to the cities, would value this if they could get their hands on it. This is also clearly an area where the processor can get involved and create an edge.

The crop rotation is a problem, but not always for the reasons you thought

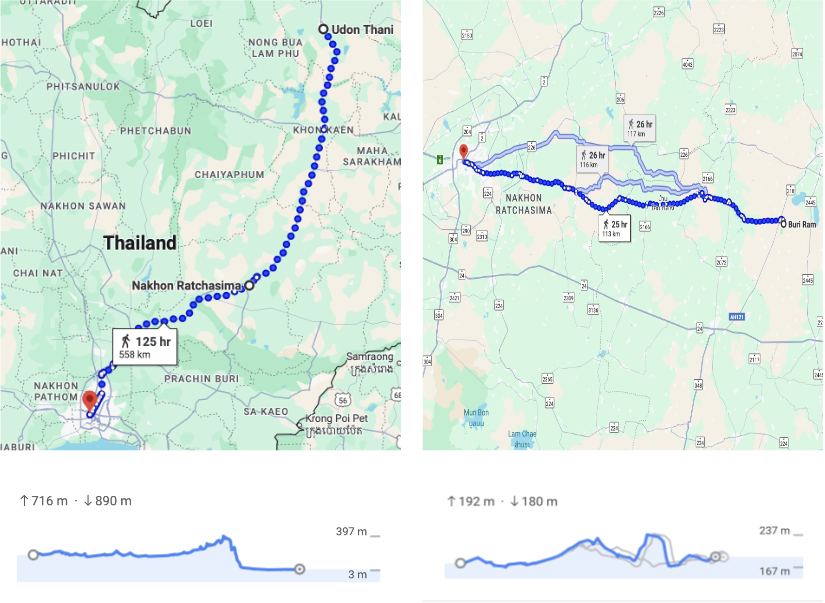

We then discussed the rotation of crops that is typical across Thailand today. My friend made a distinction between upland and lowland areas. In my mind I thought this might mean the topography of Thailand from its north to its south, which I imagined started high in the mountains of Chiang Mai and fell going down into the sea. If you walk from Udon Thani to Bangkok this is broadly true. You actually reach a peak somewhere just south of Korat (Nakhon Ratchasima), a major cassava area, before descending quickly to around sea level near Bangkok (see chart 1 below, left panel, all from google maps).

Chart 1: Upland and lowland areas across Thai cassava regions

In fact, and with a little clarification from my friend, it is the local topography that matters. So, for example, if we walk across a common cassava planting area, say from Buri Ram to Korat, we see that there are lots of hills and valleys within that area (see chart 1, right panel). The entire region is at about 200 m above sea level, but there is a lot of variation.

The main crops — rice, cassava and sugar cane — tend to organise themselves over these zones. In particular, rice is able to stand in water. Sugar cane cannot, but it is much more tolerant of wet conditions. Cassava roots simply rot if there is too much water. In truly lowland areas that are very wet and at low altitudes, only rice grows. However, in “upland” areas you may get different accumulations of water across these zones following the hills and valleys. The very wet areas grow rice. The bit in the middle tends to be sugar cane, the high bit cassava. As the prices of each of these crops move — and all these prices tend to move together — so too do these boundaries. So far so good.

However, to add to this already complex picture, labour requirements for each crop are different. Rice and sugar cane tend already to be more mechanised. Cassava still uses more labour, particularly for the harvest. Farmers then end up specialising in different zones. For example, the growing period for sugar cane (what is colloquially know as the ratoon) is three years. You plant sugar for three years, taking three cuts of the crop, then you rotate with cassava which is roughly an annual crop in Thailand. But if you are not using much labour for three years in a region, that labour might disappear to the city or other areas. That then limits your availability to grow different crops at the end of the ratoon, so perhaps you just plant sugar cane once again.

You get the picture. There is a great deal of what economists call hysteresis in the system. It is a path dependent system. Crop choices interact with and then shape local labour markets, which feed back into subsequent crop choices. There tends to be a stratification, or bands of crops across regions and these might solidify. What this might be doing is reducing the optimal rotation of different crops and leading to more of a monoculture in different growing regions than is optimal. Understanding any market failure in these cases might take a bit of work. However what is clear, and what I showed in my presentation is that carbohydrate crop yields are falling across the board. Yields peaked for rice, cane and cassava some ten years ago. Cassava mosaic disease is not the only cause of trouble.

Now, turning to the protein bit…

Despite many years in this industry, and having had many such chats with my friend, I had not understood how complicated these things might be. I just had a sense, coming into the conference, that there might be a problem with the crop rotation in this part of the world, which is why I focussed on protein.

So now we turn to protein crops. My friend confirmed that Thailand, as you might imagine, had many in the past. These are basic crops for relatively poor rural populations everywhere. Call it rice and beans. He had, early in his career, experimented with soybeans. You don’t think of these as being a tropical crop. The tricky part is the following.

Soybeans have something like a three month cycle in this part of the world, or that was his experience. You need moisture when you put them in the ground, but conditions need to be dry when you harvest.

Now think of the typical cassava crop cycle in this part of the world. You anticipate some moisture around February, or perhaps as late as April. That is when farmers tend to plant cassava. The rainy season then peaks late autumn, say September to October. You cannot get the crop out of the ground then because you would be driving tractors into waterlogged and heavy clay soil. So you wait until a little later, say by December, and the crop comes out of the ground. You can then use some of those stems to plant another crop the following year.

But imagine now that you have to rotate this essentially annual crop with a crop like soybeans. These are generally grown from late spring to early summer, and as my friend noted, they take about three months to mature.

So you have just harvested your cassava crop. You turn to soybeans, putting them in the ground around the time you would otherwise have planted cassava. The moisture levels are decent. Unfortunately, and depending exactly where you are in the country, when you turn to harvest your soybeans you find yourself in the middle of heavy rain. And even if you could harvest the beans, what do you plant for the remaining part of the year? Do you leave your fields fallow while your neighbours grow cassava?

Now, as he confirmed, you do not really get that nitrogen fixing of a carbohydrate crop like cassava by rotating with another carbohydrate crop like cane, although there are different benefits. It is thus hard to say, at this distance, exactly what impact a proper protein crop rotation might have on carbohydrate crop yields in Thailand. My instinct is that this is an issue, and this discussion seems to confirm that.

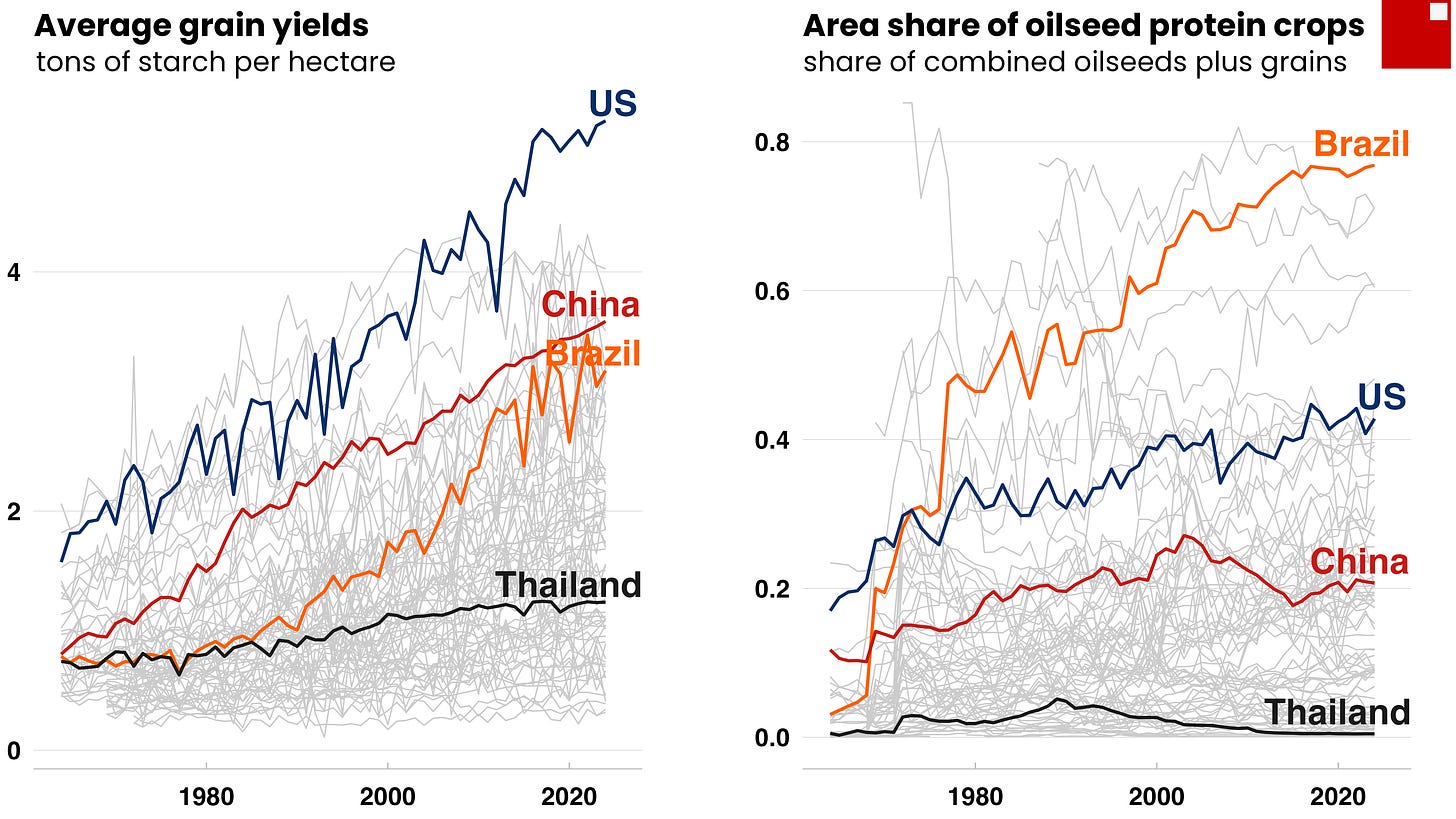

I presented the following charts at the conference (charts 2 and 3). This was quick, original analysis for the event, using widely available USDA data. If you calculate starch yields from all grains around the world (using standard coefficients for starch content in corn, wheat, barely etc.) and also the share of oilseed crops (soy, sun, rape etc.) in total grain and oilseed area, unsurprisingly both yields and protein share go up over time. That does not mean there is necessarily a relationship between both indicators. My airmiles increase travelling to Thailand, but so does my consumption of green curry.

Chart 2: The growth in grain starch yields versus the share of oilseed crops in total grain and oilseed area

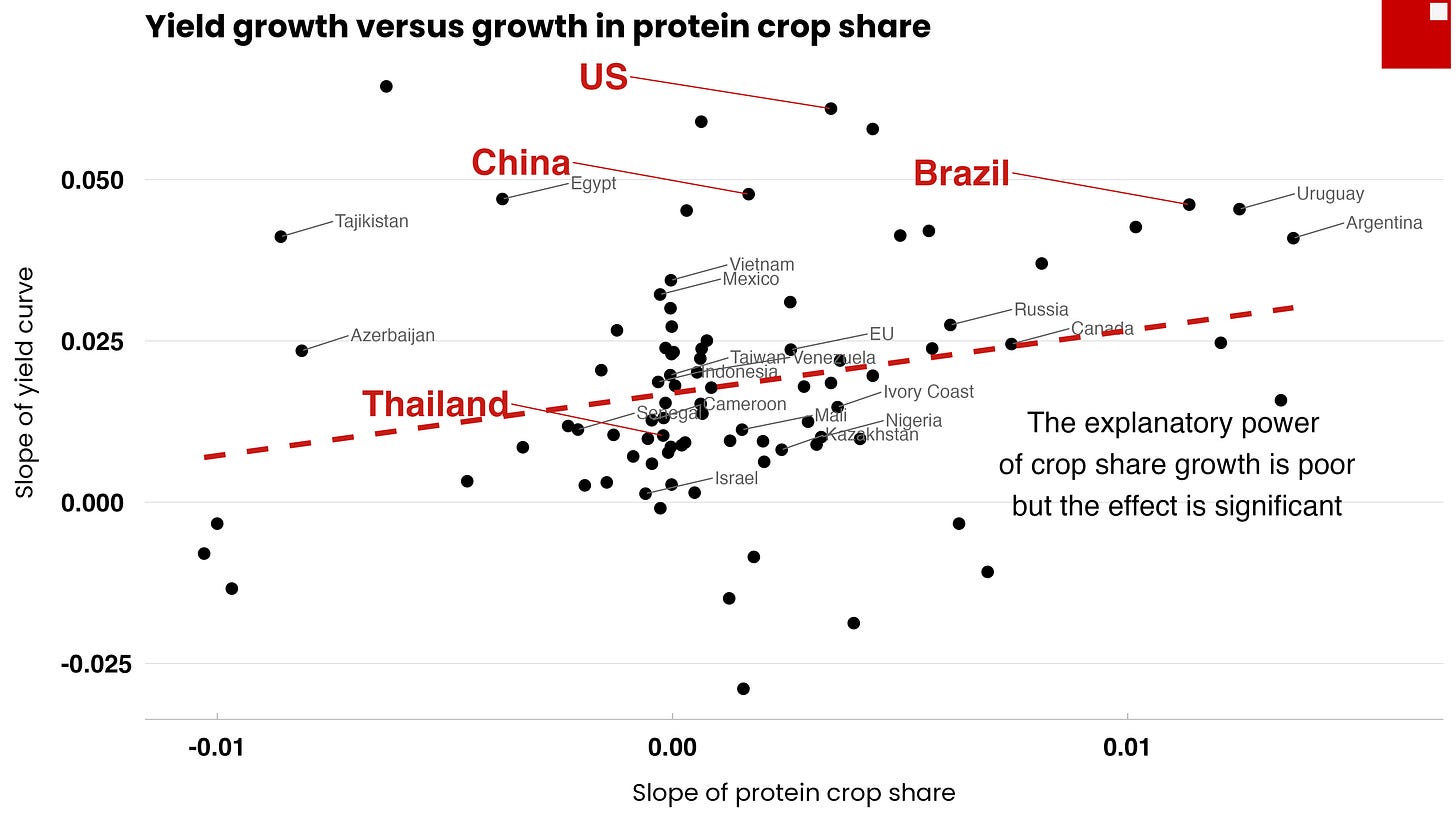

What is more interesting is the rate of growth of both indicators. The slope of the curves is a proxy for this growth. On the face of it, I would not expect the slopes of the yield curves to bear any relationship to the slopes of the protein share curves, but they seem to. There is a weak but nevertheless statistically significant relationship between the two (chart 3).

Chart 3: The growth in protein share seems to affect carbohydrate yields

I wouldn’t make too much of a quick result for a conference, but this surprised me and seems to suggest that modernisation, or whatever it is, is captured by protein share. Countries with a lot of land and mechanisation — US, Brazil, Ukraine, Argentina and so on — tend to get quickly into protein crops and they also seem to get good carbohydrate crop yield growth. I showed that south east Asia has one of the lowest protein crop area shares of any major growing region.

Protein share, climate, variety and disease are all having an affect so a proper agronomist needs to look at this, but as a pattern spotter the thing that jumps out at me is: low protein, not much of a rotation, poor yield.

What this also suggests to me is that, right now, there are some market inefficiencies across the crop rotation in this region that are highly sensitive to specific locations, weather etc. These of course open up economic opportunities if processors can identify them. Exploiting these, the crop rotation becomes much more efficient and more profitable.

Pareto and the mung bean

I looked at mung beans for the conference because these are a major export crop for Myanmar. However mung bean economics in Myanmar looks mixed at best despite there being good growth in exports.

The point is that around the world, crops are distributed according to some kind of Pareto law, not unlike wealth and city size. When you look at which crops take area, there is a huge disparity with crops like corn and soy being super successful and with a long tail of other crops. What is true in every country and every region is that some crops tend to dominate. I do not know what the ideal protein crop is for this part of the world. All I do know is that so far, no one seems to have developed it.

This is strange. I showed that rice prices have been falling against soymeal prices since the 1960s and yet there is a protein deficit in south east Asia and a massive surplus of rice. The market is giving clear signals to grow protein in this region but somehow the obstacles have prevented a better allocation of area to crops.

Cycles upon cycles upon cycles

This brief insight is surely too simplified to properly understand the issues facing the crop rotation in south east Asia, and yet I cannot imagine having a similar discussion in north America. I am pretty sure farmers there have a well worked out view of why and how they rotate corn and soybeans. Whether this is optimal in the face of any potential climatic change is a different discussion, but we surely know from the yield data that this rotation has been incredibly productive for many, many years.

These timing, implementation and organisational issues, stretching across labour markets, geography, weather and crop choices are complex, but they are not insurmountable. It is not so much a technological problem any more, so much as a problem of organisation and implementation. These are spaces in which an individual company can develop a competitive edge. I am pretty sure that is what my friend did for a living.

I hinted at the conference that the recent productivity loses may have cost the cassava industry in Thailand in the region of ten billion dollars. A direct investment of that level would likely have been transformational for the livelihoods of millions of farmers across the region. Still, there is no point looking back. Looking ahead, serious work needs to be done to understand these issues properly.

One man who has worked alongside farmers in the field his entire life has a pretty good feeling for where the problems lie, and can communicate these over fish and chips in a back street of Bangkok. The tricky part is communicating that knowledge to the governments, processors, farmers and others that can make a difference. AI is clearly helping with the communication process.

So this is the good news for an industry that is feeling a bit in the doldrums right now. In my mind, and of course I cannot be sure of this, there is some kind of major burst in crop productivity waiting for us in the future. That changes everything.

If you can add to the discussion, please feel free to comment.